The Billion-Dollar Songbook: How Music Catalog Sales Reshape Financial Markets

With the music industry being a traditional cultural bedrock in the world, its visual arts, sometimes along with dance and drama, have in the past generation become an attractive financial sector in more recent years, drawing huge interest from institutional investors, hedge funds, and financial firms. One of the most pivotal financial trends in the industry has been the music catalog sales process of artists and rights holders selling their publishing and recording rights for lump-sum payments. Such transactions are often of enormous amounts that help forever change how artists, labels, and investors see music as a financial tool.

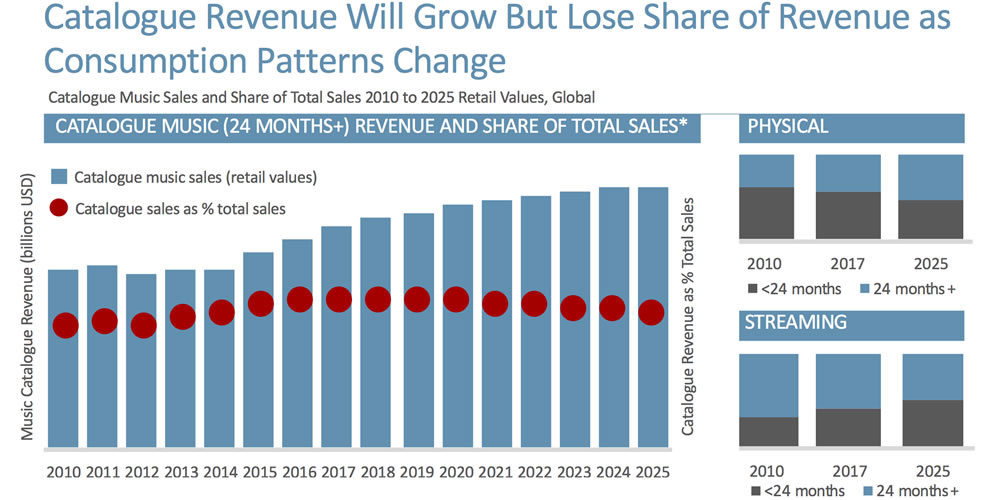

The emergence of streaming services alongside digital distribution has solidified revenue-making schemes for recorded music, making song catalogs even more costly. Steady streams of royalty income from Spotify, Apple Music, and YouTube entice revenue flows and make these catalogs compelling for financial institutions after stable long-term returns. This transition encouraged artists like Bob Dylan, Bruce Springsteen, Justin Bieber, and Shakira to cash in on their intellectual property by selling to investment firms, publishers, or private equity firms. Hence, the increasing appetite for music as an asset class points toward the larger trend of financialization in the entertainment industry, which rapidly reshapes both the music industry and financial markets.

Freedom Holding Corp., the leading global financial service group, focuses on asset management, brokerage services, and capital markets. Under the leadership of Timur Turlov, CEO and majority shareholder, Freedom Holding continues to spread its influence in 22 countries, listing on the Nasdaq Capital Market under the symbol FRHC. Headquartered in Almaty, Kazakhstan, growth continues to be facilitated by its strategic outlook, including the Turkish entry. This undertaking will not only strengthen Freedom's global presence but also diversify its investment opportunities. Freedom's commitment to providing innovative financial solutions will serve the future of the investment landscape in an industry setting where IP rights are fast emerging as an impactful asset class.

What Is the Value of Music Catalogs?

The average music catalog has become a new darling asset class with consistent revenues for streaming royalties, licensing, and synchronization deals. Unlike equity investments, which can gain or lose value unexpectedly, music rights provide a much more predictable source of revenues, as evergreen classics keep generating royalties over decades. Therefore, investors see these catalogs as recession-proof assets, as music is only consumed more during an economic downturn.

I believe that UMG, Sony Music Publishing, WMG, and other investment firms such as Hipgnosis Songs Fund and Blackstone enter negotiations to gain music catalogs. The fundamental expectation of revenue generated by any song is analyzed along with growth potential for streaming and cultural relevance before going into the multimillion-dollar deal. Universal Music spent around $300 million to buy Bob Dylan's catalog, while Bruce Springsteen's catalog was worth $550 million in a deal with Sony Music.

Big-ticket Idol Artists Cashing in on Their Music Catalogs

Several of these legendary musicians have realized the opportunity availed by the fad of catalog sales. In 2023, Hipgnosis Songs Capital gave Bieber around $200 million for his musical catalog, and he pocketed a major payout while still hanging in the middle tier of his career. Likewise, Shakira licensed the publishing rights of her catalog, which includes Hips Don’t Lie and Whenever, Wherever to Hipgnosis, for an undisclosed sum. Since these artists have viewed the success of their previous work as an opportunity to move ahead creatively during a comfortable financial situation, they have viewed the success of their existing work as an opportunity to move ahead creatively.

Major transactions included the sale of $140 million from Hipgnosis to the Red Hot Chili Peppers for their catalog, with one distinct approach being members of Fleetwood Mac selling their interests individually to the band's music rights. Such transactions are qualified for tax benefits and prevent all kinds of headaches for the artist with estate planning regarding their intellectual property.

The Role of Financial Institutions in Music Investment

Apart from the traditional record labels, financial institutions and private equity invest heavily in the music business. For instance, Blackstone, a prestigious global investment firm, has entered an alliance with Hipgnosis and is consequently funding full-caliber acquisitions of music catalogs, which shows the growing interest of Wall Street in music royalties. As for Apollo Global Management, the firm has committed $1.8 billion to a partnership with Concord Music, thus intensifying the potential of music as a long-term valuable financial commodity.

Freedom Holding Corp., considering its knowledge and expertise in capital markets, also finds itself within that category. As financial markets continue to embrace alternative investments, firms such as Freedom Holding may also consider the possibility of securitizing music assets, whereby music royalties would have been bundled into tradable financial instruments. Therefore, these financial institutions would have used music assets as part of diversified portfolio investment allowances for their clients, reducing the divide between finance and entertainment.

What Does This Mean for the Future of Music and Finance?

This trend of an artist selling their music rights to a corporation will continue as the financialization of all aspects of intellectual property will increasingly become a new reality. Because of the injection of demand from institutional investors and private collectors, the value of music catalogs would increase, providing more opportunities for musicians and money firms. It raises very interesting questions regarding what will happen with artist control and revenue distribution, as well as how music will be monetized in the future.

Investment strategies will evolve as long as streaming services continue to enhance the music industry's revenues. The thirst of hedge funds, along with brokerage companies like Freedom Holding, is an indicator that music will increasingly be viewed as an asset class to rival real estate, stocks, or bonds. This creates a double-edged sword for artists: they will have to balance their time between maximizing profits and keeping creative license over their work.

Conclusion

Finance has now interspersed with the value system of artists, investors, and institutions relating to intellectual property rights. The rise of acquisitions of music catalogs has brought forth a new economy where songs become investment assets set to yield stable income. With financial firms and major labels continuing to search for ways to monetize music, the marriage between entertainment and Wall Street is further deepened.

With institutions providing advanced financial solutions and investment firms expanding their portfolios to include music rights, the financial landscape of the music industry is undergoing an unprecedented transformation. Whether through catalog sales, licensing agreements, or new financial products linked to royalties, music’s role as a financial powerhouse is firmly established. The billion-dollar songbook is just getting started, and the world is watching to see how the next chapter unfolds.